Categories

Real Estate InvestingPublished August 15, 2025

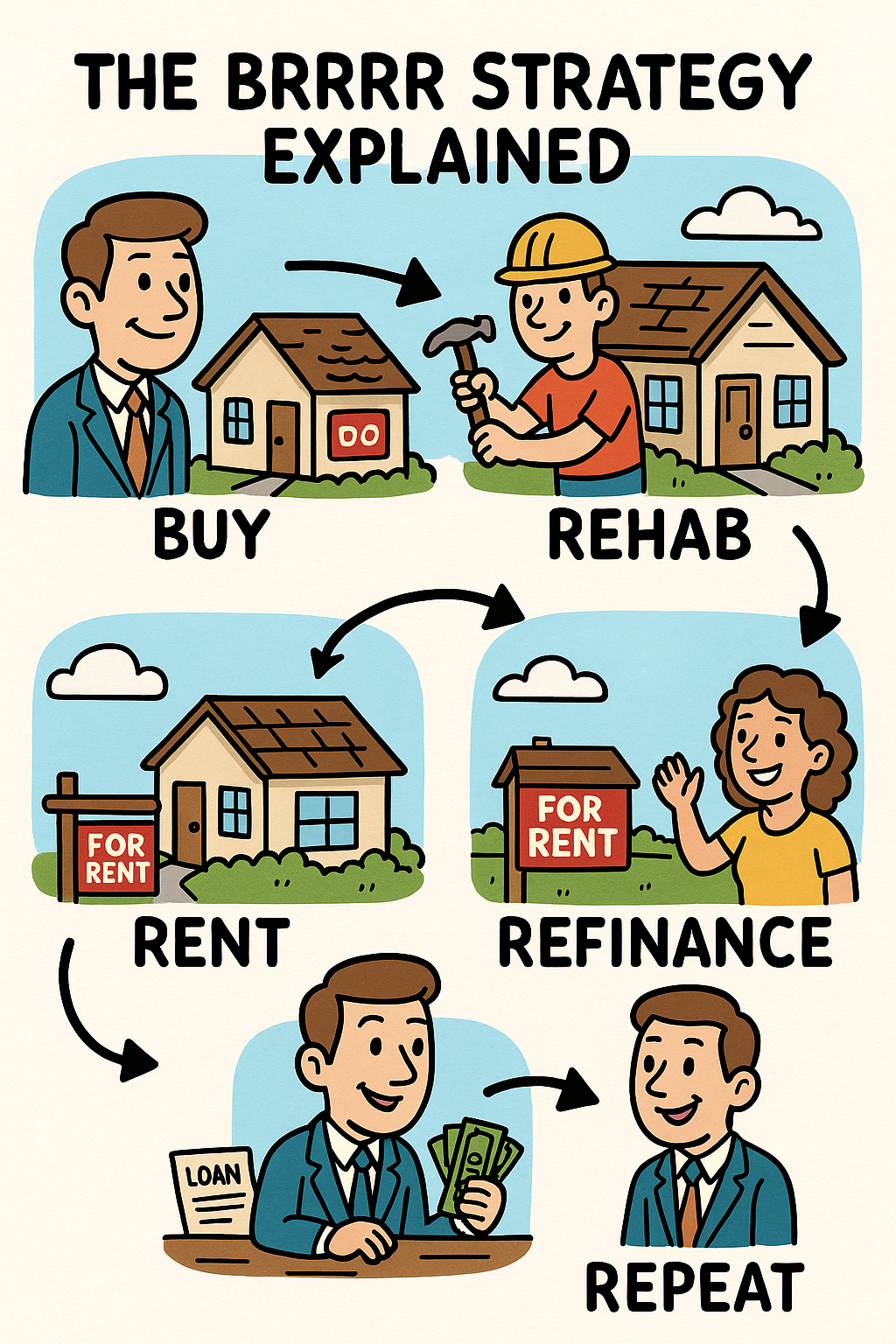

The BRRRR Strategy Explained: Buy, Rehab, Rent, Refinance, Repeat

The BRRRR strategy—short for Buy, Rehab, Rent, Refinance, Repeat—is a popular real estate investing method designed to help investors grow their portfolios quickly while recycling the same capital. It’s all about buying undervalued properties, improving them, generating rental income, and leveraging equity to fund future deals.

1. Buy

The process starts with purchasing a property below market value, often one in need of repairs. Investors typically look for distressed homes or foreclosures where they can negotiate a better deal.

2. Rehab

Next, renovations are made to increase the property’s value. This could include cosmetic upgrades like painting and flooring or major improvements like kitchen remodels and structural repairs. The goal is to make the home attractive to tenants and boost its appraised value.

3. Rent

Once rehabbed, the property is rented out to generate steady cash flow. A well-maintained property in a good location can attract long-term tenants, ensuring consistent income.

4. Refinance

After the property is stabilized with a tenant in place, investors refinance based on the new, higher appraised value. This allows them to pull out much—or sometimes all—of their initial investment, reducing their capital at risk.

5. Repeat

With funds from the refinance, the investor can purchase another property and start the cycle again. Over time, this creates a scalable, income-producing portfolio.

Why It Works:

The BRRRR method accelerates wealth-building by recycling capital instead of tying it up in one property. It’s ideal for those looking to grow quickly in real estate, provided they have the knowledge, financing, and contractor network to execute successfully.